Overview

Chetwood Financial Limited (‘Chetwood’) have established a strong and comprehensive governance structure, recruiting a highly experienced and talented Board to work alongside and challenge the Executive team in the delivery of its strategy.

The governance framework establishes a set of relationships between Chetwood’s Management, its Board, its shareholders and other stakeholders. This framework provides the structure through which Chetwood’s objectives are set, the means of attaining those objectives and monitoring the performance of them. It also defines the way authority and responsibility are allocated and how corporate decisions are made.

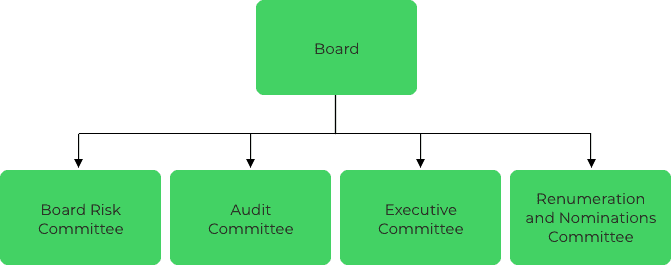

The below diagram sets out Chetwood’s overarching corporate governance structure.

Board Risk Committee

The role of the Board Risk Committee is to oversee Chetwood’s risk appetite and risk monitoring, to provide oversight and advice to the Board on current risk exposures and future risk strategy, and to assist the Board in fostering a culture that recognises the benefits of a risk-based approach to internal control.

Some of the main duties of the Board Risk Committee include:

- Acting as the Risk Committee of Board, retaining sufficient experience and expertise to do so.

- Promoting a risk awareness culture within Chetwood.

- Formulating future risk strategy, including determination of risk appetite and tolerance which are subsequently recommended to and approved by the Board.

- Considering risk profile relative to current and future strategy and its supporting risk appetite, identifying risk trends, concentrations or exposures and any requirement for policy change.

- Regularly receiving and reviewing management information with respect to Chetwood's risk appetite and the current and future trend performance, through assessment of key portfolio management information and key risk indicators.

- Reviewing the design and implementation of risk management policy across Chetwood in particular operation of the Risk Management Framework.

- Reviewing the design and implementation of risk management and measurement strategies across Chetwood and the procedures for monitoring the adequacy and effectiveness of those processes.

- Constantly reviewing and evaluating macro-economic trends, threats and opportunities in the deployment of business strategy.

- Recommending to the Board for its approval, policies and frameworks that ensure optimal risk processes and outcomes for the business in relation to the approved business strategy.

- Considering any training and development needs for Committee members or those involved in credit and fraud risk management to ensure the requisite skills are available to monitor and control all relevant risks.

- Identifying where adverse trends arise and recommend corrective action to remediate performance issues and escalate to the Board any performance concerns that impact delivery of business strategy.

Board Audit Committee

The role of the Board Audit Committee is to assist the Board in overseeing the systems of internal controls and external financial reporting, and to provide oversight and advice to the Board on current and potential future audit exposures of Chetwood.

Some of the main duties of the Audit Committee include:

- Formulating future audit strategy.

- Acting as the Audit Committee of Board, retaining sufficient experience and expertise to do so.

- Considering if the accounting policies which have been adopted by the Board are appropriate to the circumstances of Chetwood, have been consistently applied and are adequately disclosed in the annual report and accounts.

- Reviewing and monitoring the integrity of Chetwood’s financial statements to review significant financial reporting judgements contained therein and to ensure that they give a “true and fair” view of Chetwood’s financial status.

- Recommending to the Board whether to approve Chetwood’s full year accounts and to review any formal announcements relating to the Chetwood’s financial performance.

- Recommending to the Board for its approval, policies and frameworks that ensure optimal processes and outcomes for Chetwood, in relation to application of account principles and internal control processes.

- Reporting to the Board, identification of any matters in respect of which it considers that action or improvement is needed, and making recommendations as to the steps to be taken.

- Providing a link between the Board and the external auditors, independent of Chetwood’s management and to liaise with the external auditors, particularly in relation to their audit findings.

- Making recommendations to the Board, for it to put to the shareholders for their approval in general meeting, in relation to the appointment, re-appointment and removal of the external auditor and to approve the remuneration and terms of engagement of the external auditor.

- Reviewing and monitoring the external auditor’s independence, effectiveness and objectivity and the effectiveness of the audit process, taking into account relevant professional and regulatory requirements.

- Monitoring and reviewing the effectiveness and adequacy of Chetwood’s Internal Audit function (and its activities) and to review the integrity of Chetwood’s internal financial controls.

- Reviewing and approving the annual Internal Audit Plan.

- Approving the appointment of the Internal Auditor or to make recommendations to the Board with regard to the removal and dismissal of the Internal Auditor.

- Overseeing and holding management accountable for timely remediation of audit actions.

Executive Committee

The role of the Executive Committee is to assist Chetwood’s Chief Executive in the performance of duties, including: strategic planning, implementing a strong supporting operating model and implementation of systems and controls whilst monitoring the operational and financial performance; assessing and controlling risk and prioritising resources; developing a high performing Senior Management team and monitoring customer proposition and experience.

Whilst the Board has overall responsibility for the bank's activity, it delegates authority for the executive management of Chetwood and its day to day operational activities through the Executive Committee.

Some of the main duties of the Executive Committee include:

- Preparation of robust business plans to support the achievement of strategic objectives, budgets and operational plans.

- Optimisation and allocation of investment and resources to deliver Chetwood’s objectives.

- Embedding the processes, procedures and controls to enable decision making frameworks and efficient remedial intervention.

- Developing a high performing Senior Management team, having effective oversight Senior Management and monitoring customer proposition and experience.

- Management and regular review of Chetwood’s operational and financial performance.

- Responsibility for the integrity of management information and financial reporting systems.

- Compliance with legislative and regulatory requirements.

- Management and reporting of capital adequacy and liquidity requirements.

- Ownership for the identification and management of the risk profile and issue resolution.

- Succession planning, managing and developing talent.

Remuneration and Nominations Committee

The Remuneration and Nominations Committee has responsibility for advising the Board on developing an overall remuneration policy. The Committee also has responsibility for the appointment of Board members, Executive team and any other employee that the committee deems to have a substantial compensation package.

Some of the main duties of the Remuneration and Nominations Committee include:

- The development and implementation of a remuneration policy for the allocation of fixed and variable pay.

- The development of a remuneration policy in alignment with Chetwood’s strategy and objectives, risk appetite, values and long-term interests of Chetwood and all stakeholders.

-

During the appointment of Board members, Executive team and other appropriate employees, the committee shall consider:

- The individual’s level of quality and competence

- The individual’s knowledge, skills and experience

- The overall diversity of Chetwood, including under-represented genders

- The overall level of knowledge, skills and experience within Chetwood

- Horizon scanning the broader remuneration agenda in society and ensuring that Chetwood continues to set best practice for bank remuneration and is well positioned to meet any changes or additional disclosure requirements.

- Reviewing, challenging and approving proposals from the CEO for the remuneration of each individual Material Risk Taker (MRT).

- Reviewing, challenging and approving the overall reward distribution for other staff.