Understanding the recession: what it means for your finances

The UK is facing a lengthy recession. We’re not quite in it yet, although you’d be forgiven for thinking that we are, given news headlines over the last six months. However, rising energy prices and rampant inflation mean the threat of recession still looms large over Britain.

The economic climate means prices are rising at the fastest rate in 40 years, outpacing pay growth. As the economy contracts, people are seeing a significant reduction in their spending power in real terms.

Faced with a cost-of-living crisis, households around the UK are already tightening their belts, and the thought of recession might have you concerned about your finances. Here, we set out what a recession could mean for your money and the steps you can take to weather the storm.

Understanding the recession

Put simply, a recession refers to when there is a significant dip in a country’s economic activity over two quarters (or a six-month period.) This is why we’re not currently in a recession – data shows that we narrowly missed economic retraction for two consecutive quarters by a narrow margin.

When an economy is in recession, companies tend to produce fewer goods and services, and people might lose their jobs as the economy struggles with output.

The most popular way of defining a recession is gross domestic product (GDP), which measures the size of the economy – this includes the total value of goods and services, income generated by the production of goods and services, and all the money spent on these products (known as exports).

Ultimately, recessions can be caused in a number of different ways:

• Unpredictability and economic shocks – If businesses can’t predict how the economy will change, it can be difficult for them to make informed decisions. Unexpected events like the Covid-19 pandemic and the conflict between Russia and Ukraine have made predicting consumer behaviour challenging. Ultimately, both have led people and companies across the globe to avoid making any financial decisions – causing a decline in economic activity.

• Low consumer confidence – Low consumer confidence in the economy prompts people to stop buying products and services. This can create a vicious cycle: if demand for goods and services is significantly reduced, this eventually reduces business profits and the capacity to hire more employees.

With fewer jobs in the economy, sales continue to slow, meaning that manufacturers scale back production. This can also mean cutting back on jobs, leading to more unemployment and even less consumer spending.

• Higher interest rates – Higher interest rates make it more expensive to borrow money. In turn, this discourages consumers and businesses from borrowing money to make purchases or investments, leading to reduced demand for goods and services in the wider economy. In turn, this means that businesses hire fewer people.

Then, as spending in the economy decreases, inflation decreases. However, if high-interest rates cause the economy to contract too much, it can lead to a recession.

Currently, the Bank of England has said that it is committed to reducing inflation by raising interest rates – you can learn more about this and what it means for your finances here.

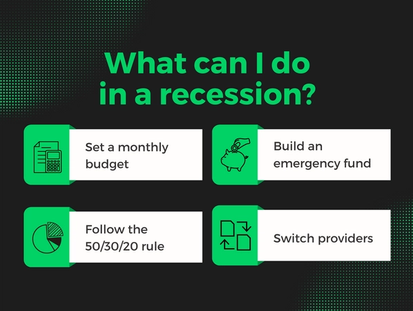

What can I do?

In the current climate, it’s likely that your personal finances could take a hit. While managing your money during this period may be difficult, there are a number of things you can consider doing to maximise your money and make the best of a bad situation.

• Set a monthly budget – If you don’t already keep to a budget, it would be wise to scrutinise your incomings and outgoings to come up with an affordable budget that you can keep to each month. Although a simple suggestion, this can be difficult in practice but means that you’re more likely to be able to continue contributing to your long-term savings goals.

• Build an emergency fund – Uncertain times remind us all how important it is to have an emergency fund that you can rely upon when needed. If you can, start building an emergency fund and add to it regularly – even small contributions make a big difference. Ultimately, having 3-6 months’ worth of your expenses in reserve is what you should aim for.

• Follow the 50/30/20 rule – Spending 50% of your after-tax income on needs, 30% on wants and 20% on savings is a good rule of thumb to follow if you’re able – this ensures that you can keep adding to your savings pot to make the most of high interest rates while they’re available.

• Switch providers – Spotting opportunities to save money by switching to cheaper providers, cancelling subscriptions you don’t use, and looking for loyalty and cashback programmes can all go a long way to helping you manage your finances.

Where should I go if I need help?

If you’re concerned about increases in the cost of credit and the rising cost of living, you’re not alone. If you’re struggling with your finances, there are plenty of free and independent advice services available to support you and help you make things more manageable.

StepChange

StepChange provides free debt advice to help you deal with your debt and set up a solution. We’re here to help you.

Citizens Advice

Citizens Advice offers free and confidential advice for debt and money management, benefits, housing and other life areas.

MoneyHelper

MoneyHelper is a free service provided by the Money and Pensions Service, sponsored by the Department for Work and Pensions.

Turn2Us

Turn2us is a national charity providing help for those who are struggling financially.