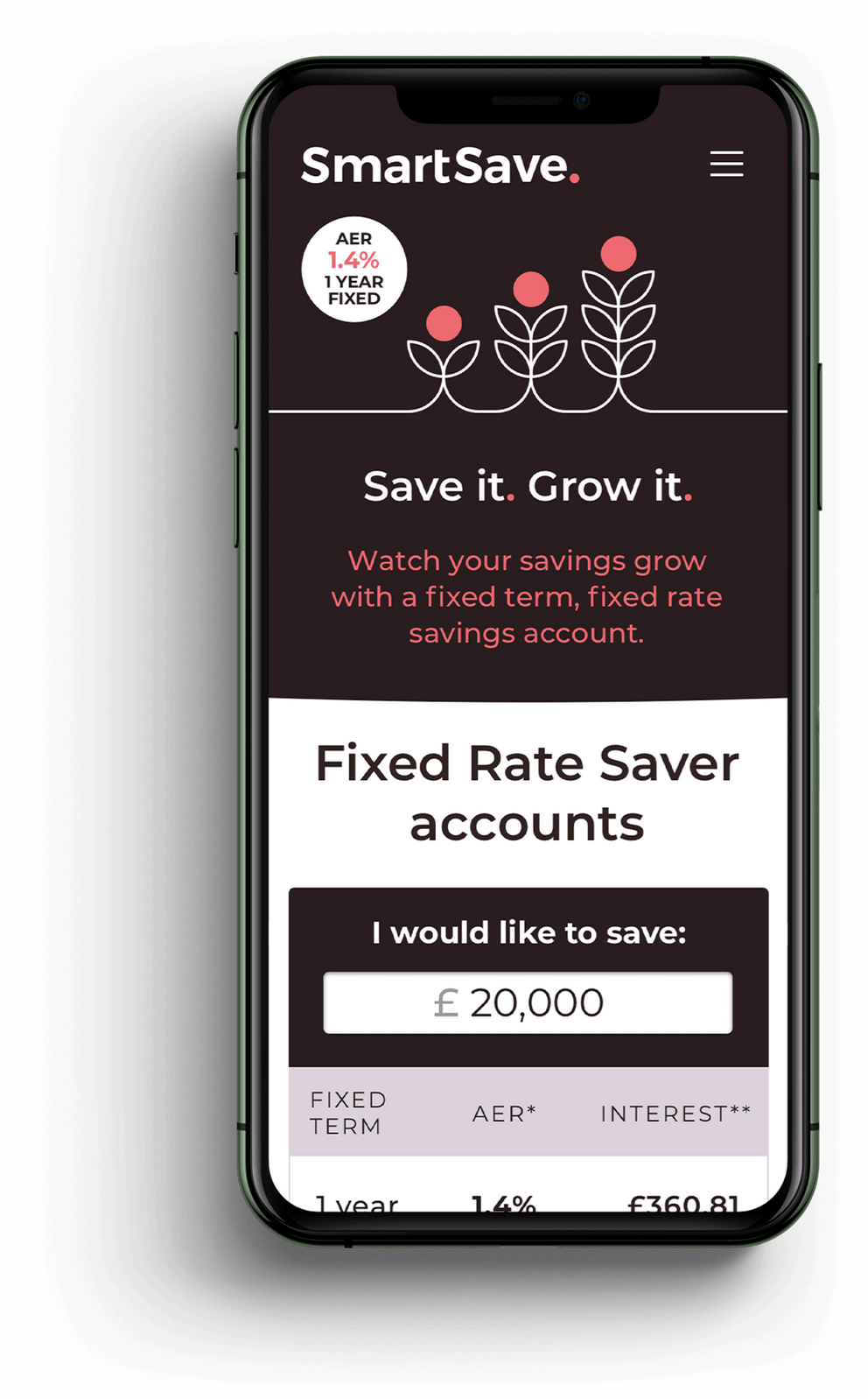

When we got our full banking licence, we launched SmartSave. We followed the same approach as LiveLend, listening to customers to create a simple way to save. Customers told us they wanted to open and manage their account entirely online, with support from a UK team if they needed it.

They wanted to earn interest from day one and, most importantly, they didn’t want their rate to drop to 0% at the end of their term. Plus, they wanted to know their money was 100% protected by the FSCS. So, we did just that.

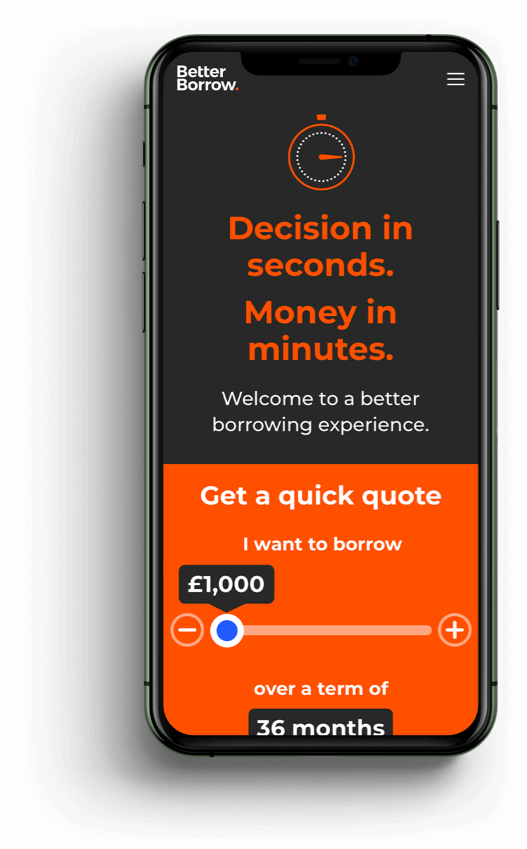

Our latest product is BetterBorrow, a loan designed alongside our customers to be as quick and simple as possible. It has a fast application process with an instant online decision. There’s no paperwork, no long forms and customers receive their money in 30 minutes or less. It’s a better borrowing experience from start to finish.

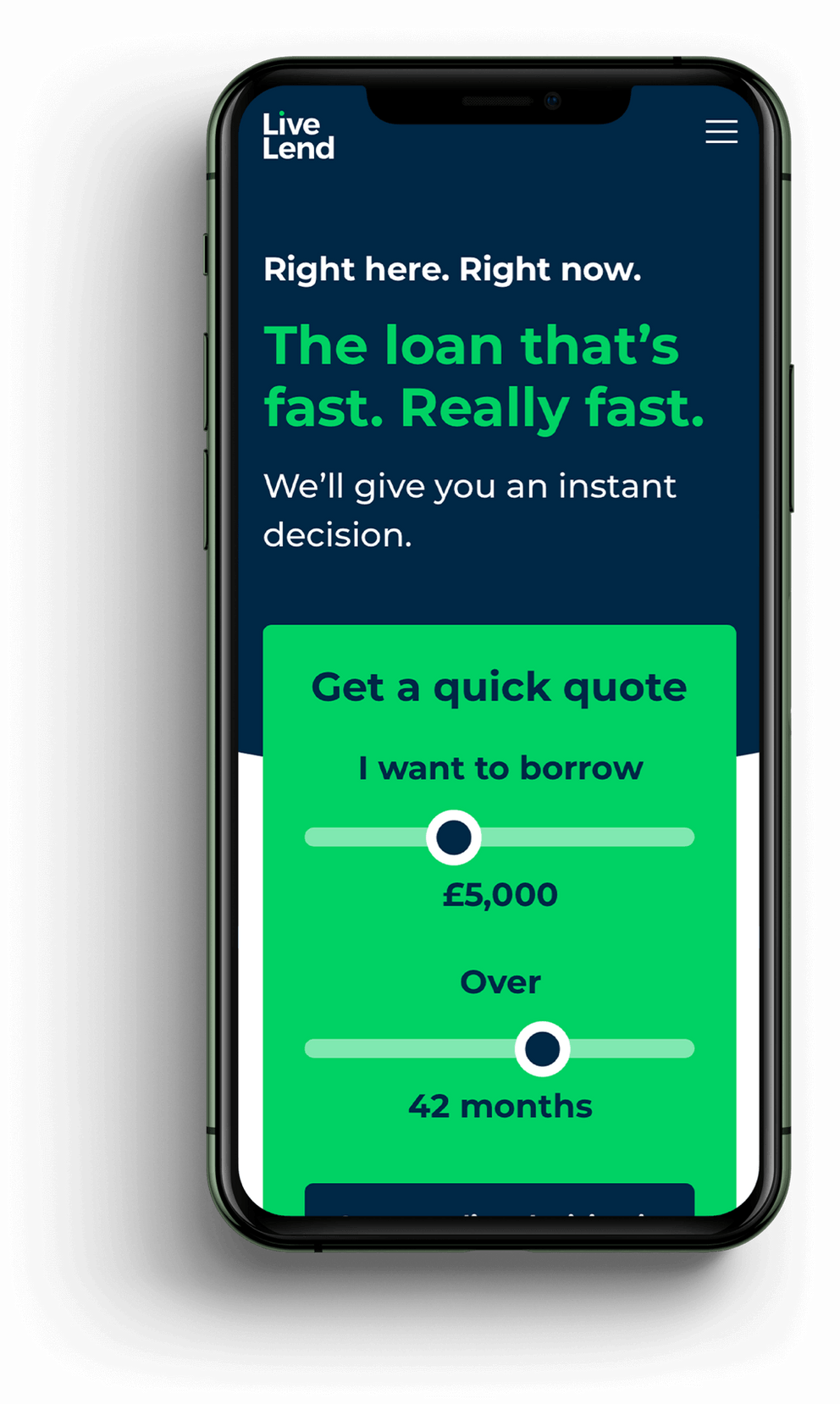

LiveLend was designed with our customers to help them manage life's ups and downs. Understanding what was wrong with other loans helped us to design a better product.

Along with a rate that reduces as their credit score improves, customers benefit from a pre-approved, real rate offer that has no impact on their credit score. This helps them to shop around for the best deal. We also got rid of all fees as we think it's unfair to charge customers when they miss a payment.

Our tech

We only build technology where we believe we can create something better than the market, so decisioning and automating data driven insights have been at the forefront of our development. We've invested heavily in advanced data analytics and data sciences, creating a strategic data environment hosted natively in the AWS cloud, and incorporating advanced analytic tools such as machine learning and neural nets.

For other services we use our ecosystem of digital partners. This ensures we can stay ahead of the competition on service, cost and security. Our platform connects with innovative identity management, credit and data sources, payment firms and many other partners. All of which can be switched in and out to ensure our products remain current, secure and competitive.